The latest release of the Business Distress Index for Q4 2024, released by Real Business Rescue using Companies House and Red Flag Alert data, paints a bleak picture of the financial health of UK businesses. Chelsea Williams, a corporate insolvency adviser at Scotland Liquidators, dives into the latest release of the Business Distress Index with a spotlight on construction in Scotland.

Construction company insolvency data Q4 2024

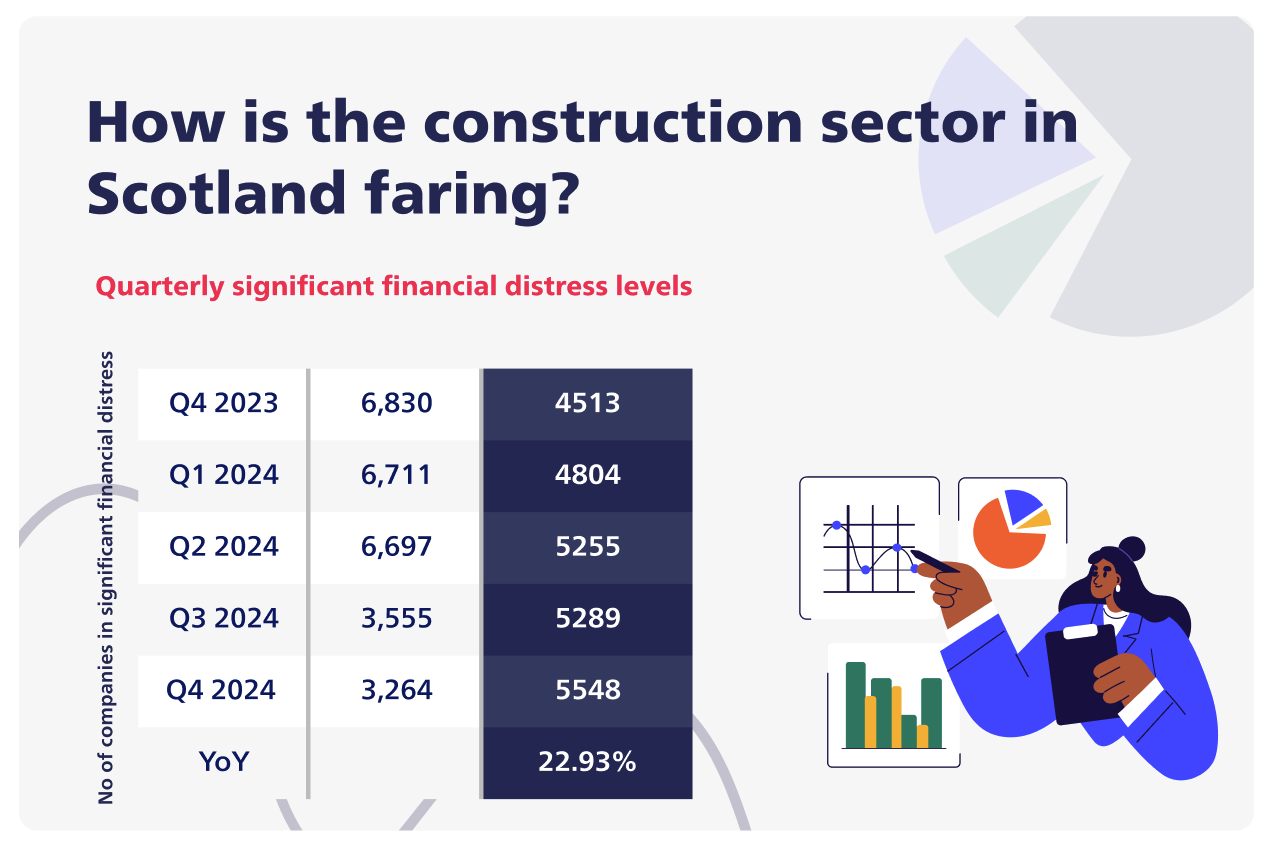

Construction is at the top of the list of sectors in significant financial distress in Scotland, with 5,548 businesses in this category, followed closely by support services (4,823) and real estate and property services (3,096). This trend follows suit in the critical financial distress category.

When the data is expanded to include England, Scotland, Wales, and Northern Ireland, construction continues to show the highest financial distress levels. This indicates a worrying year ahead as the industry battles countless challenges, from skilled labour shortages to rising operational costs and supply chain pressures.

Where does the Autumn Budget fit in?

Less than three months after the Autumn Budget, critical financial distress climbed by 50% as the Chancellor of the Exchequer, Rachel Reeves, cracked the whip and set out to claw back record funds to restore public finances. The Autumn Budget announcement, which was Labour’s first major fiscal statement since coming into power, delivered mixed news to the construction sector.

Although tax hikes announced at the Autumn Budget came as a blow to businesses across the UK, much investment was directed to the construction sector which softened the blow. New infrastructure and development housing targets will provide continuity of demand for construction companies. However, supply chain disruption, high borrowing rates, and material cost inflation must subside for construction companies to reap the full benefits.

New year, new hope

As the new tax year approaches, construction companies must prepare for a change in the tax rules as Employers National Insurance Contributions and the National Living Wage are set to increase which will impact labour costs.

According to the latest construction forecast data from BCIS for Q4 2024 to Q4 2029, building costs are expected to increase by 17% over the next five years, while tender prices will rise by 19% over the same period. Prices are expected to grow more slowly than input costs in 2025 and this trend is forecasted to reverse from 2026.

BCIS forecasts a return to growth from 2025 fuelled by housing and infrastructure spending. While they do expect to see housing output increase, annual construction output for housing would need to see a gargantuan 68% increase on 2023 levels to achieve 370,000 homes annually.

Dr David Crosthwaite, chief economist at BCIS, comments: “Industry sentiment data continues to present positive readings, although since the Autumn Budget these are now less optimistic.

“…the state of the public finances puts much public spending at risk and the sluggish economy will likely dampen growth in both industrial and commercial sectors.”

While construction companies have a track of hurdles to race through, there is optimism as a consistent pipeline of work lies ahead which will boost skills development, employment rates, and sector demand.